Assumptions may cause home buyers to spend thousands of dollars in the long run

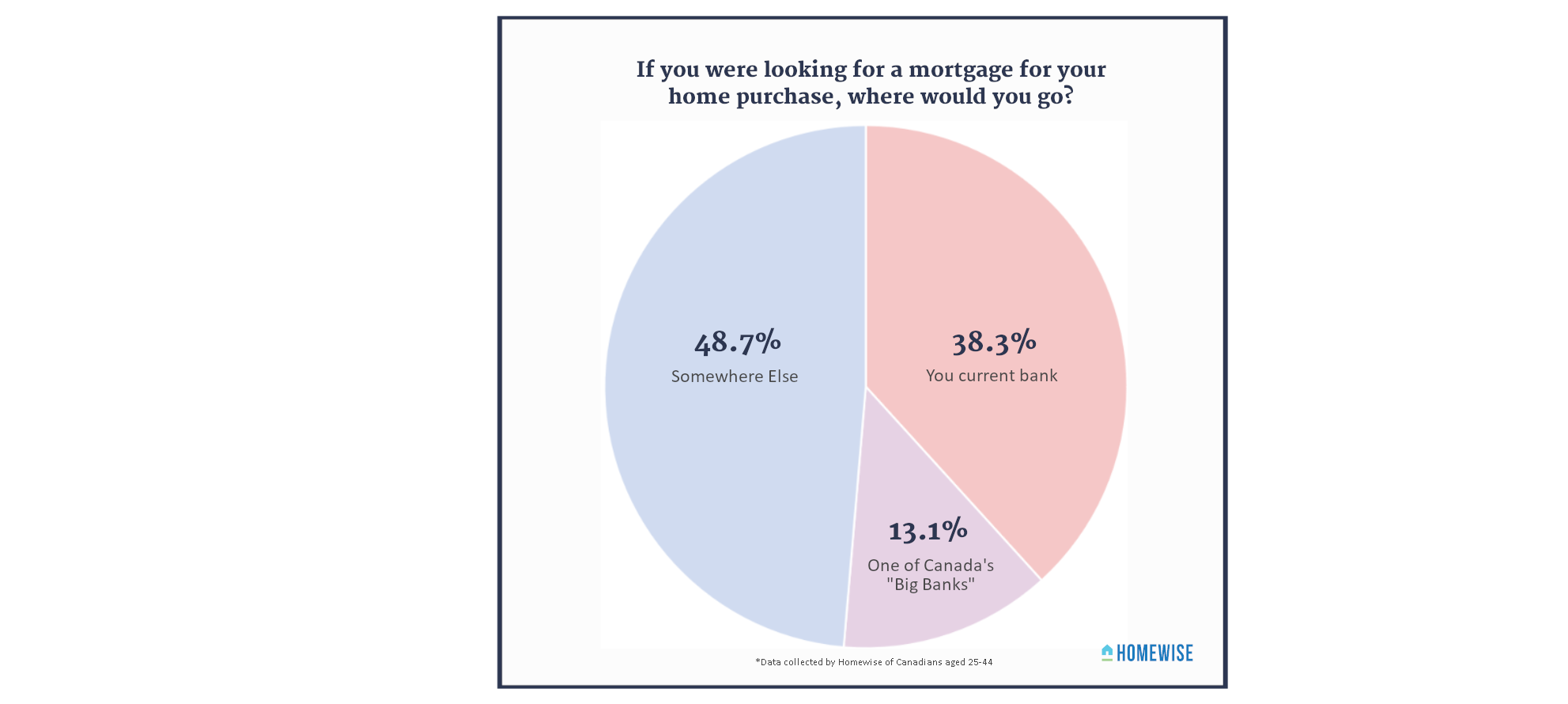

TORONTO, April 16, 2021 - If you were looking for a mortgage for your new home purchase, where would you go?

Results from an early April 2021 cross-Canada poll by HOMEWISE showed that 37.9 per cent of potential home buyers would go to their current bank; 13.1 per cent answered one of Canada’s big banks 49.1 per cent said somewhere else.

These results from a survey of mortgage-seekers between the ages of 25 to 44 (many of whom are first-time home buyers) confirmed that more than half of Canadians do not shop around for their mortgages. This means that over the course of their amortization, they may end up paying thousands of dollars more than is necessary.

According to Jesse Abrams, CEO and Co-Founder of Toronto-based Homewise, “We were surprised by how many Canadians would only go to one bank for a mortgage. This is an outdated and inefficient way to finance one of the biggest commitments of a home-buyer’s life. By not shopping around, home-buyers can lose money on rates, but that’s only part of the story. Mortgage-providers offer different features such as penalties if a mortgage is broken before the term is complete, which can be thousands of dollars more depending on the lender. It’s a case of comparing apples and apples before signing on the dotted line, and it can be complicated. That’s why we created Homewise: to streamline the process online, especially in these Covid lock-down times, making it easier for the consumer to enter the home market and get the right mortgage for their needs from multiple different lenders. This is especially important for first-time buyers, who may not be aware of the intricacies of the market.”

Turning to a familiar bank may seem like the easiest solution, which is probably why more than half of Canadians do that. It is complicated, and there is a lack of transparency in many of the available options – especially if a buyer considers only one lender. Among the numerous considerations when shopping for a mortgage are the different types of interest rates available (fixed, variable or a hybrid of the two); and key features such as payment frequency; pre-payment options; and whether the mortgage is open, closed, portable, assumable, and/or has low penalties if you have to break it early.

“It’s about due diligence,” Abrams said. “We’re talking an outlay of hundreds of thousands of dollars, so why go for only one option? We know that consumers obsess about interest rates, when that is only part of the equation. Too many Canadian borrowers, especially first-time home buyers, don’t realize they have other options besides banks, and they are far too often leaving thousands of dollars on the table.”

- 30 -

ABOUT HOMEWISE

Based in Toronto, Canada, Homewise is a national Proptech that offers an online mortgage process that provides borrowers with a simple experience where they are matched with their best mortgage options from over 30 banks and lenders in minutes. Homewise also provides borrowers with a personal Mortgage Advisor to guide them at each step from approval to close. Homewise manages the negotiation, confusion and paperwork to save borrowers time and a lot of money. Homewise focuses on first-time home buyers, offering pre-approvals and approvals; however, Homewise also provides refinances and switch options as well. Visit thinkhomewise.com

NEWS MEDIA CONTACT

David Eisenstadt

tcgpr

(C) 416-561-5751